How To Integrate Trick Platform With EU Customs and Other External Systems

The interaction between Italian Customs and Monopolies Agency (Agenzia delle Dogane e dei Monopoli, ADM) information system AIDA and TRICK platform sets the pillars to cooperate with EU Customs.

In the previous blogpost "TRICK platform: flexible, scalable and reliable" we spoke about the conceptual design lying behind the platform architecture of TRICK, and we also deepened the type of services that the platform will perform, that is, the collection and data management of secure product data all along the supply-chain together with a set of six services available in an open B2B marketplace.

In this scenario, and accordingly with the goals of the TRICK platform to provide an affordable technology for the management of circular product information based on data collection and secured by Blockchain, the platform design could not leave out the integration with external systems. In this case, Task 2.1 (reference deliverable 2.1: “TRICK platform architecture", led by Domina in its role of Technical Responsible) investigated the possibilities of communication with other platforms, starting with the ADM Information System AIDA and looking at integration with EU Customs, setting new standards of cooperation.

The role of EU Customs, the AIDA use case

All import-export documentation goes through Customs control, and in Europe, there are guidelines for all the Member States that cannot be ignored. Nowadays, the role of Customs is going through an outstanding expansion. Mentioning the EU Customs strategy by the European Commission: “Customs authorities not only collect customs duties and VAT on imported goods, and excise duties where applicable, but they also check those goods for many non-financial purposes, such as to ensure the safety and security of the goods and to ensure that they meet EU product compliance requirements, food, health and environmental standards and rules, Intellectual Property Rights and much more”.

A link between Customs activities regulating EU and non-EU trade and TRICK can therefore contribute to make all the processes of data and documentation collection and verification more secure and streamlined, and consequently significantly improve the procedures of anti-counterfeiting and verification on the safety of goods, the investigations against frauds and false documents and products.

About AIDA and how it works

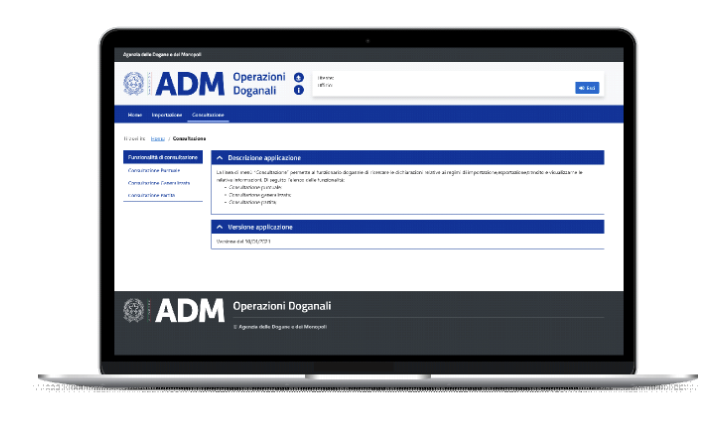

AIDA (Customs Excise Integrated Automation) is the information system of ADM. It operates within the taxation information system and logically consists of application services constituted by all the components dedicated to Customs, excise, gaming, and tobacco processes. AIDA interacts with economic operators through user-to-system and system-to-system interfaces, with National public administrations through services based on the interoperability model towards the Public Connectivity System, and with the European Union and its Member States for services involving data exchange through a Gateway and a specific middleware.

Sample of AIDA mask (Image Credits:Domina)

Sample of AIDA mask (Image Credits:Domina)

How AIDA could interact with TRICK: standards, interoperability model, and web services

The method of interaction of AIDA with TRICK has been carried out, taking into account a set of standards defined by ADM, together with the interoperability model and web services that regulate the communication between ADM and the systems of private entities. According to this model, communication between ADM and the systems of private entities takes place through registration on the unique portal of ADM using the Public Digital Identity System (SPID), the Electronic Identity Card (EIC) or the National Service Card (CNS). After the registration, the user can choose to operate in a User-to-System mode, using the interface provided by the PUDM, or in a System-to-System mode, by requesting a certificate of enrolment.

The actual method (AS IS) and the method to come (TO BE), hypothesized through interoperability with TRICK, can be summarized as follows:

Image Credits: Domina

Benefits for Customs and private entities, and chances of scalability

The interaction between TRICK and the ADM information system puts in place new possibilities for the improvement of communication among all the stakeholders, with positive effects on both Customs and private entities sides.

As for Customs, the TRICK platform may act on the state-of-the art with:

- Increase and acceleration of the digital transition in the Customs systems procedures;

- Simplified checking of the documentation: Customs may have direct access to the visualization and consultation of the documents to be controlled, with substantial savings in terms of time and effort;

- Blockchain security gives a plus to the certifications in terms of transparency and reliability, and contributes to hindering counterfeiting and fraud.

While benefits for private entities may refer firstly to:

- Streamlining of interaction with the Customs systems and submission of relevant certificates;

- Reduction of the activities of data and documentation collection in the case of customs checks;

Decrease of the opacity and fragmentation of the value chains, by means of the Blockchain validation that allows to better certify the origin of products and their compliance to regulations.

Communications with other EU platforms

All the EU countries have similar systems, therefore the AIDA technological environment of reference stands as an example of standardization that can pave the way for communication with other EU platforms. Once the interoperability between the TRICK platform and AIDA has been activated, a connection with specific European platforms can be assumed through interoperability within the AIDA system, e.g. REX and the EU Customs Single Window Certificates Exchange (EU CSW-CERTEX). Moreover, the TRICK project can actively contribute in Italy to opening a new way for the validation of the blockchain tool in the Customs environment by the Agency for Digital Italy (Agenzia per l'Italia Digitale, AgID). In fact, AIDA may set a fast track, supporting internal systems already validated by AgID.

CONTACT PERSON & EMAIL ADDRESS:

- Stefano Fasana (email)

LINKS: